Coinbase-backed Ondo Finance opens Asia Pacific office, ONDO token up 73%

Ondo Finance, backed by Coinbase, expands into Asia Pacific, capitalizing on 73% weekly ONDO token surge.

Company opens its first APAC office and appoints Ashwin Khosa as VP for Business Development in the region.

The strategic move aligns with Ondo’s dominant position in tokenized securities, targeting APAC’s digital asset fervour.

Ondo Finance, a prominent US-based issuer of tokenized securities backed by Coinbase, is making headlines with its strategic expansion into the Asia Pacific region.

This move comes amidst a remarkable 73% weekly surge in the value of its ONDO token, showcasing the platform’s growing influence. The company’s entry into the dynamic APAC market is set to capitalize on the region’s fervent interest in digital assets, fueled by a thriving crypto community and evolving regulatory frameworks.

Ondo Finance’s footprint in Asia Pacific

While officially announcing its strategic expansion into Asia Pacific, Ondo Finance also announced the inauguration of its first office in the Asia Pacific region, marking a calculated move to tap into the escalating enthusiasm for digital assets.

While the specific location remains undisclosed, the company’s founder and CEO, Nathan Allman, expressed his enthusiasm for the expansion. He highlighted the active and rapidly growing crypto community in the Asia Pacific, emphasizing the appeal of Ondo’s tokenized exposure to U.S. assets.

To spearhead this strategic move, Ondo Finance has enlisted the expertise of Ashwin Khosa as the Vice President of Business Development for Asia Pacific. Khosa, with a decade of institutional business development experience in Hong Kong, brings valuable insights into the nuances of on-chain finance and the Asia Pacific market.

This expansion aligns seamlessly with Ondo’s existing dominance in the tokenized securities realm, boasting nearly 40% of the global market share. The platform’s three main tokenized products—OUSG, OMMF, and USDY—enable global investors to access key US-based asset classes in a tokenized format.

ONDO token price movement

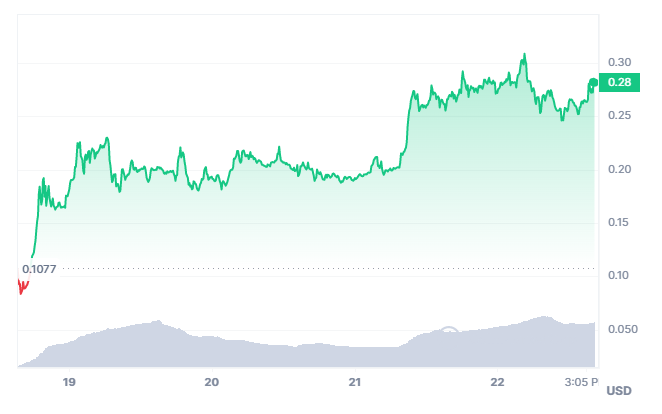

The expansion into Asia Pacific comes on the heels of a remarkable 73% weekly increase in the value of Ondo Finance’s ONDO token. At press time, ONDO was trading at $0.2812, up 3% in 24 hours.

ONDO price chart

ONDO price chart

This surge reflects growing confidence and interest in the platform and its tokenized offerings.

Ondo Finance has been actively shaping its future landscape with strategic collaborations. Notably, partnerships with Mantle Network and Solana have gained attention, emphasizing the collaborative efforts to bring USDY to their respective blockchain networks.

Additionally, the Ondo Foundation’s recent announcements, including a points program and a proposal to unlock the ONDO token, further underline the platform’s commitment to advancing on-chain finance and expanding its global influence.