Bitcoin Dips to $38,000 With Further Losses in Sight

Key Takeaways

Bitcoin hit a low of $38,000 on Feb. 20.

Further selling pressure could push prices to $37,000 or even $33,500.

This support level must hold to avoid a sell-off to lower lows.

Share this article

Bitcoin appears to be shedding its recent gains as buyers dry up. The lack of interest in the spot markets could result in a deeper correction.

Bitcoin Falls Below Crucial Support

Bitcoin is struggling to find support while whales remain sidelined.

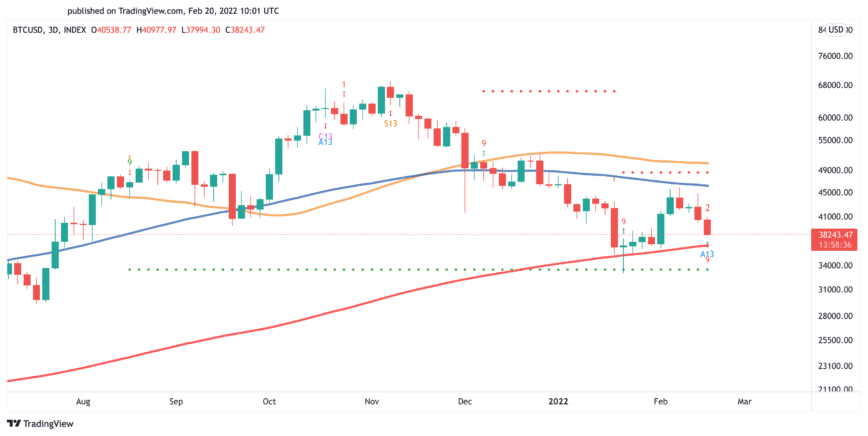

The number one cryptocurrency has broken below its psychological $40,000 support level to hit a low of $38,000 at press time. The downtrend appears to be driven by overleveraged traders in the futures markets. Meanwhile, whales on the spot markets appear to be waiting for the asset to drop lower before accumulating more tokens.

Roughly 67.6% of all accounts on Binance Futures are net-long on Bitcoin at press time. Data suggests that traders remain overconfident about the future price action as the BTC/USDT Long/Short Ratio has risen to a monthly high of a 2.08 ratio.

The optimism among traders can often create the conditions for a long squeeze, which appears to be taking place at the moment. The lack of whales re-entering the market further increases the chances of a squeeze.

On-chain data shows that the number of addresses on the network holding between 100 and 100,000 Bitcoin has remained flat over the past month. These wealthy market participants do not appear interested in buying Bitcoin at the current price levels, possibly because they are anticipating lower lows.

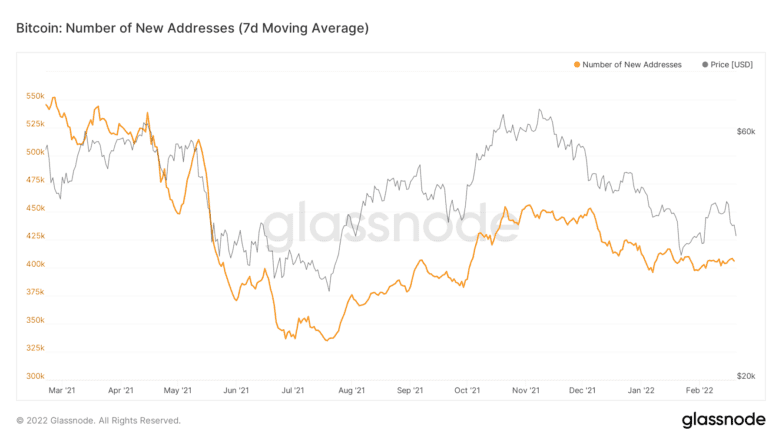

The lack of interest in the spot markets can also be seen in the number of new daily addresses joining the network. Despite the 40% price rebound Bitcoin experienced in the last three weeks, the network is not experiencing substantial growth. Glassnode data shows that the number of new daily addresses remains stagnant at an average of 400,000 per week.

Given the high correlation between network growth and Bitcoin’s price, it is reasonable to wait for a spike in this on-chain metric that supports the continuation of the uptrend.

Until that happens, Bitcoin could be looking test the 200-day moving average on the three-day chart at $37,000 or it may test Tom DeMark’s setup trendline at $33,500. Failing to hold above this crucial support zone could trigger a cascade of liquidations in the futures market, pushing prices further down.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Ukraine Passes Vote on Bill to Legalize Bitcoin

The Ukrainian parliament has voted in favor of a bill granting legal status to Bitcoin and other cryptocurrencies. Ukraine Makes Crypto Legal Ukraine is the latest country to adopt a…

SEC Has Received 200 Letters on Grayscale’s Bitcoin ETF

The U.S. Securities and Exchange Commission has received an influx of letters on the possible approval of Grayscale’s upcoming Bitcoin spot ETF, a decision that is still pending. Investors Enter…

NFT Express: Your on-ramp to the world of NFTs

At Tatum, we’ve already made it super easy to create your own NFTs on multiple blockchains without having to learn Solidity or create your own smart contracts. Anyone can deploy…

Bitcoin Breaks Below $40,000, Sending Market Into Red

Other lower cap assets were harder hit as Bitcoin tumbled Friday. Bitcoin Trades Below $40,000 Bitcoin is trading in the red again. The number one crypto asset dipped below $40,000…