Bitcoin Ordinals Inscription Exceeds 5M After Doubling in a Week: Data

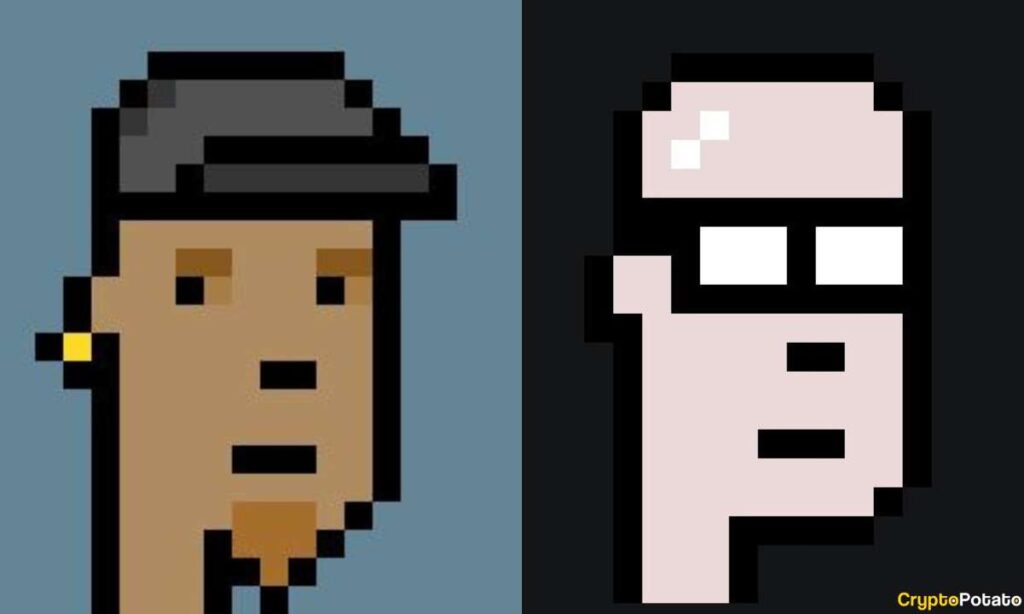

Ordinal inscriptions are on fire. Users are continuously flooding the Bitcoin network with images, video games, and other content.

There are now more than 5 million inscriptions. Over the past seven days, the total inscription count has more than doubled from 2.5 million.

Ordinals Skyrocket

According to data from Dune Analytics, text-based inscriptions, also known as the BRC-20 token standard, accounted for a vast majority of the Bitcoin ordinal inscription. At the time of writing, its dominance was at 86.52%. Image-based inscriptions, on the other hand, had a relatively smaller footprint of 9.5%

The total market cap of BRC-20 tokens was recorded to be $690 million at the time of writing. Currently, there are a total of 14,200 new tokens hosted on the Bitcoin blockchain. Riding on the hype of PEPE, even a Bitcoin-based version of the meme coin made it to the 3rd rank in terms of market cap. The first two positions were held by Bitcoin-based tokens called “ordi,” and “nals.”

Ordinal Inscriptions are digital assets, similar to NFTs, inscribed on a satoshi in the Bitcoin network, a process that was made possible due to the Taproot activation in 2021. Its introduction has created another use case for the network beyond mere transfers of value.

This week, Binance unveiled plans to add support for Bitcoin Ordinals in its NFT marketplace. The crypto exchange will also be offering royalty support and additional revenue-generating opportunities for creators.

Positive Side-Effect?

The resurgence of the ordinals craze has prompted a spike in Bitcoin network activity, including fresh highs in transactions. However, the subsequent congestion in the network has sparked concerns in the community.

The increased demand for Bitcoin’s block space resulted in the corresponding rise in transaction fees. Data from BitInfoCharts revealed that the Bitcoin network’s transaction fees are skyrocketing to roughly $31, a level that was last seen in April 2021.

Rising transaction fees and longer confirmation wait times have made it harder to use the flagship crypto asset for small transactions. The burst of new activity, however, is being viewed as a positive side effect for the Bitcoin miners as transaction fees surpassed the regular mining subsidy.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.