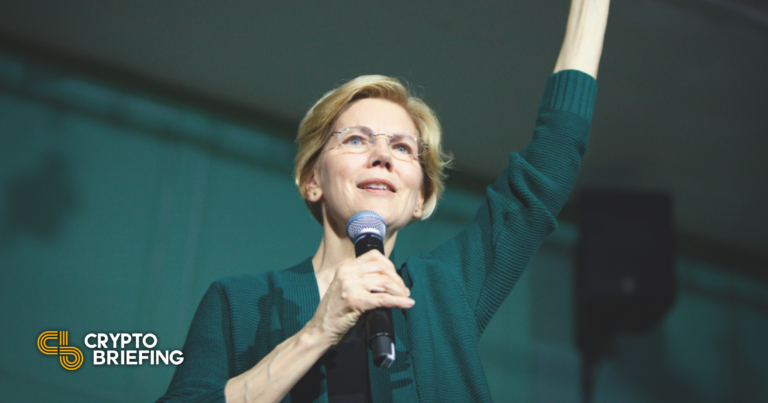

Elizabeth Warren Tells SEC to Discuss Crypto Regulation

Key Takeaways

In a newly published letter, Elizabeth Warren has asked the SEC to provide answers on regulatory questions.

Depending on the SEC’s answers, the regulator may be granted additional authority to close regulatory gaps.

Warren also commented on cryptocurrency in June.

Share this article

U.S. Senator Elizabeth Warren has published a letter to the SEC, asking the regulatory body to confront the potential risks of cryptocurrency and answer questions about current regulation.

Regulations Are Needed, Warren Says

In a statement related to her letter, Warren noted: “While demand for cryptocurrencies and the use of cryptocurrency exchanges have sky-rocketed, the lack of common-sense regulations has left ordinary investors at the mercy of manipulators and fraudsters.”

Warren’s letter observes that, in a five-month period, 7,000 individuals reported a total of $80,000 in losses from crypto scams. That statistic was based on a report from the FTC published in May. She added that even legitimate crypto investments come with risk.

Warren demanded that the U.S. SEC comment on certain matters by July 28—namely, whether cryptocurrency exchanges are operating fairly, the problem of jurisdictional gaps, the legality of decentralized exchanges and DeFi, and the extent of the SEC’s own authority.

She drew attention to Binance, which is currently facing regulatory blocks in the U.K. She observed that Binance operates worldwide but has no base of operations and used the exchange as an example of a business that has taken advantage of jurisdictional gaps.

The letter explains that Congress may need to act to give the SEC authority to close regulatory gaps, depending on the SEC’s answers.

Warren Has Commented on Crypto Before

Warren has also made similar comments in the past. In June, she suggested that the U.S. government must confront crypto threats. She also criticized the power consumption involved in mining.

Additionally, in 2018, Warren highlighted the risks of investing in Initial Coin Offerings after the conclusion of the ICO boom.

Elizabeth Warren is a Massachusetts Democrat; she serves as the the Senate Banking Committee’s Subcommittee on Economic Policy.

Disclaimer: At the time of writing this author held less than $75 of Bitcoin, Ethereum, and altcoins.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.