First Bitcoin ETF Opens Up, CME Futures Spike Higher

The first exchange-traded fund (ETF) backed by bitcoin (BTC) futures contracts went live today on the NYSE Arca exchange. And judging from the first few minutes of trading, the new ETF received a warm welcome in the market.

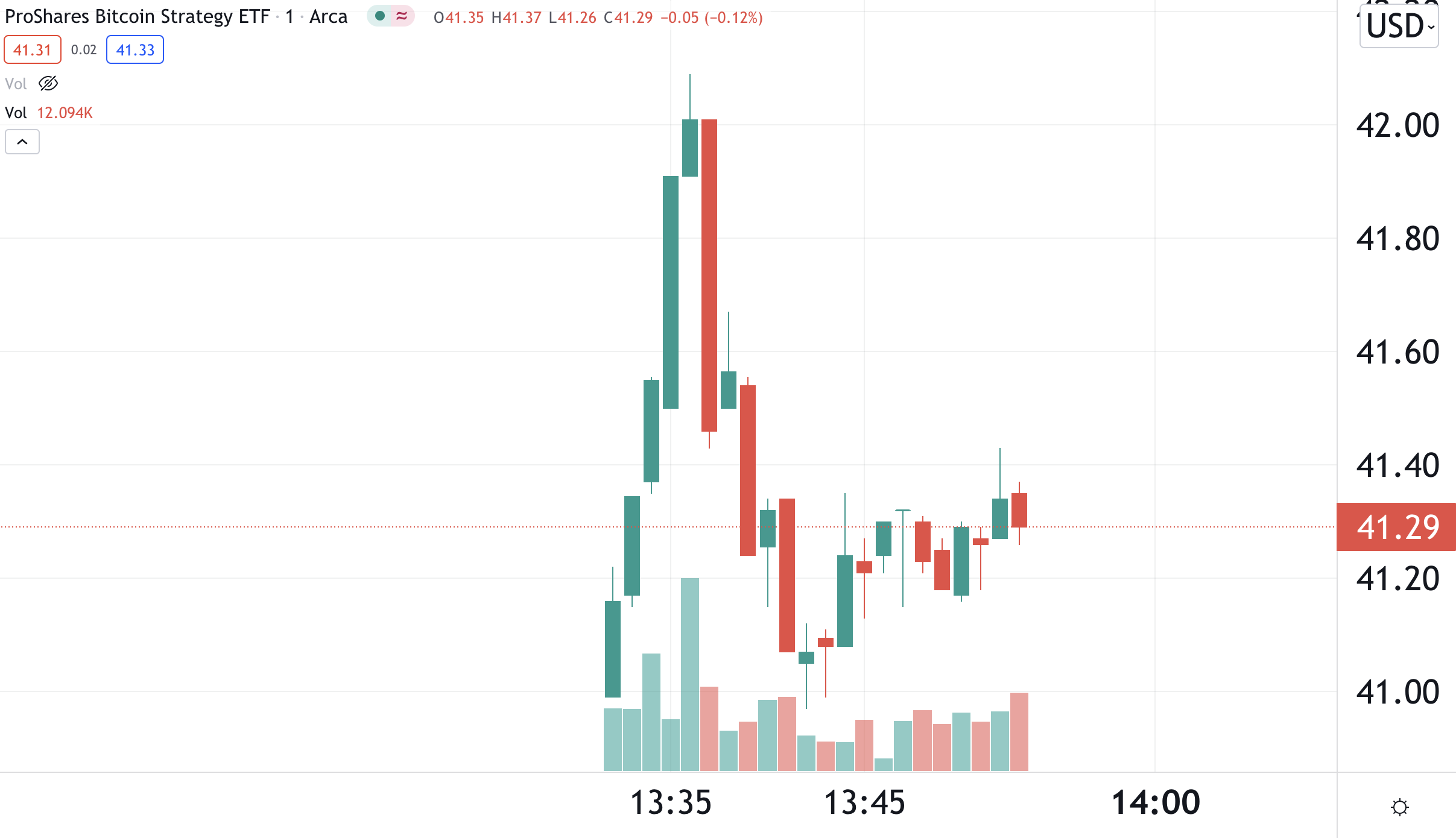

Launched by ETF issuer ProShares, the ETF with the ticker BITO went live today at 09:30 EDT (13:30 UTC), with representatives from ProShares ringing the opening bell at the New York Stock Exchange.

As the market opened, the ETF immediately shot up in price, rising by almost 1.4% within the first five minutes of trading. The first recorded trade for the ETF was made at a price of USD 40.99 per share, with the price rising above USD 42 before reversing to the downside.

Worth noting is also that the bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME) traded sharply higher almost immediately upon the ETF launch, likely as a result of speculation that the ETF will become a large new buyer in the bitcoin futures market.

At 13:47 UTC, the CME bitcoin futures contract expiring in October traded at USD 63,855, nearly USD 1,000 higher than the spot price of bitcoin on Binance. Over the past hour, the futures market moved as much as 3.3% higher, while Binance’s spot price moved up by only 1.7%.

The launch of a bitcoin futures ETF has received widespread attention in recent days, with some analysts suggesting that it could fuel rising premiums on bitcoin futures traded on the CME relative to spot prices as seen on crypto-native exchanges. As a result, the ETF has sparked renewed interest in the so-called bitcoin basis trade, where arbitrage traders take advantage of the price difference between bitcoin spot and futures markets.___Learn more: – Bitcoin Futures ETF to Start Testing Market on Tuesday Amid Pullback Talks- Institutional Crypto Adoption: Three Factors to Watch

– Experts Disagree on Prospects of Bitcoin ETF in 2021 as Deadline Nears- Bitcoin Rallies Above USD 60,000 on ETF Hopes