Meme Coins Deployers Accumulate Funds Before Hiking Liquidity

The popularity of meme coins has led to a surge in price manipulation and other fraudulent activities. Deployers are known to accumulate large amounts of the coins before adding liquidity to the market, which can cause the price to skyrocket and leave unsuspecting investors with worthless coins.

Meme coins have gained popularity in recent years. People often make these coins as a joke or for fun, and they typically have little to no practical use. Despite this, meme coins have become a hit, with many people investing in them in hopes of a quick profit.

However, the dark side of meme coins will not go away. Many deployers of these coins have been accumulating large amounts of funds before adding liquidity to the market. This behavior can lead to price manipulation and other bad outcomes.

Understanding the “Memecoin” Frenzy

Launching meme coins with little to no development behind them is one of the problems here. This means they are vulnerable to price manipulation, as there is often no real-world value to support their price. Furthermore, launching such coins with a limited supply can make them vulnerable to price manipulation.

A tactic deployers use is accumulating a large amount of the coins before adding liquidity to the market. They do this by buying up large volumes of the coin from early investors or using bots to inflate the price. Once the deployer has gotten a significant number of the coin, they can add liquidity to the market, which can cause the price to skyrocket. This price manipulation can be devastating for unwitting investors. Many people need to grasp the risks involved in investing in meme coins, since they can lose a fortune when the price crashes.

Meme coins often lack regulation by any governing body, presenting another problem. This means there is no oversight to bar price manipulation or other fraudulent activities. Additionally, because many meme coins launch anonymously, holding the deployer accountable for any wrongdoing can be hard.

In some cases, deployers of meme coins have used their influence to pump the coin’s price and then sell their holdings for a significant profit. This can cause the price to crash, leaving investors with worthless coins. In extreme cases, deployers of meme coins have engaged in exit scams, where they disappear with the investors’ funds.

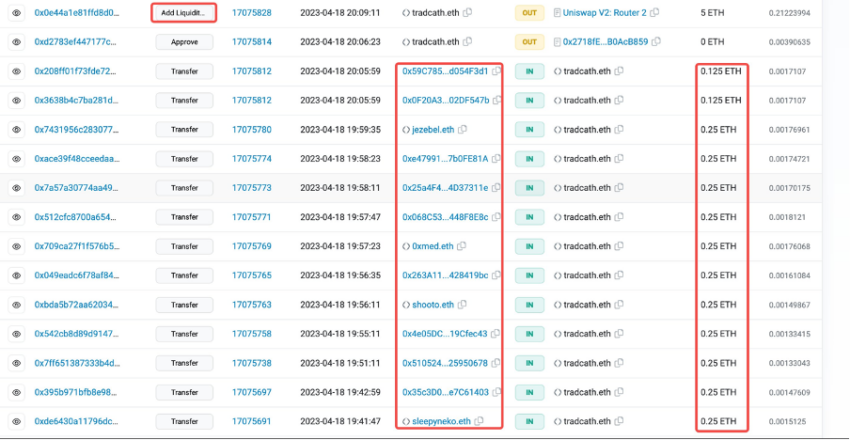

Examining Live Cases

Some MEME coin deployers have accumulated many funds before increasing liquidity. This means that there is a possibility of manipulation by a specific group. For instance, a Twitter profile with the handle ‘X-explore’ raised concerns about the behavior exhibited by different cohorts.

Herein, meme coins with similar behavior include WOJAK, TRAD, and NEET. Here are a few examples:

Token name: WOJAK with deployer address: 0x8591F46A5E9B081289a3CFC4b5381F3c6e88389B

Another one is TRAD with deployer addresses: 0x4fE6ac27C8B992356D5fB8547b1dEb2540efA34E

Last, is NEET exhibiting similar activities.

Additionally, the frog-themed PEPE token saw one lucky buyer turn a $250 investment into an on-paper profit of over $1 million. Saw a massive meme coin surge led by the newly-launched PEPE. The resulting “meme coin frenzy” entailed high trading volumes snarling up the Ethereum network. Another fellow meme coin that witnessed a surge is REKT, which rose by 90% in a day.

These are just some instances where similar meme coins can lure investors trying to get instant profits. However, caution is in order. Most meme coins have little to no fundamental value and trade entirely on popularity. Meme coins issue in large quantities with market prices of less than a cent to make them look cheaper and attract potential buyers.

Serious Risks

Low-liquidity tokens and meme coins can pose issues for investors. These coins often launch with a limited supply and may need more trading activity on cryptocurrency exchanges. As a result, buying or selling these coins at a fair price can take time, leading to severe price fluctuations and other issues.

One of the issues with low liquidity tokens and meme coins is that they are vulnerable to price manipulation. Because there is little trading activity, it can be easy for a single investor or group of investors to manipulate the coin’s price. This can lead to big losses for other investors unaware of what is happening.

Additionally, low-liquidity tokens and meme coins can be tricky to sell. If there are no buyers, investors may end up holding onto the coin for an extended time, which can be risky. In some cases, investors may have to sell the coin at a loss, which can wreck their portfolio.

Another area for improvement with low liquidity tokens and meme coins has to do with real-world value. Many of these coins are launched as a joke or for fun and may have little practical use. This can make it hard for investors to determine whether the coin is a good investment or not.

Finally, low-liquidity tokens and meme coins can be vulnerable to hacking and other cybersecurity risks. These coins need strong security measures to protect investors’ funds since they often launch with little to no development. This can make it easy for hackers to steal the coins and leave investors with huge losses.

Take Precautions and DYOR

Users must do their due diligence before investing in any cryptocurrency to protect themselves from the risks associated with meme coins. This means researching the coin and the deployer to determine whether they have a solid track record or will likely engage in price manipulation or other fraudulent activities.

Additionally, it is essential to diversify your cryptocurrency portfolio. Investing in various coins can help lower risk and protect you from losses if one coin experiences a price drop.

Finally, it is essential to remember that investing in cryptocurrency is inherently risky. While some meme coins may offer the potential for big returns, they also come with a high level of risk. As with any investment, it is essential to carefully consider the risks and rewards before investing your money.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.