vBitcoin Option Markets Flip Bullish as BTC Rally Heats Up, Price Rises Above $28K

In a matter of days, investors’ view on the outlook for the Bitcoin price has flipped from being bearish to bullish, as represented by a shift in options market pricing. The flip in investor sentiment comes as the Bitcoin price surges above the $28,000 level for the first time since early last June, taking gains since earlier monthly lows to over 44%.

Yearly gains are now closer to 70%, with Bitcoin pumping amid 1) increased demand for assets deemed as a safe haven given troubles in the global banking system and 2) increased bets that US Federal Reserve won’t engage in much further tightening. Indeed, in the week ahead, the Fed’s policy meeting will be a key event, with investors split over whether the bank will deliver one final 25 bps rate hike.

Options Markets Flip Bullish

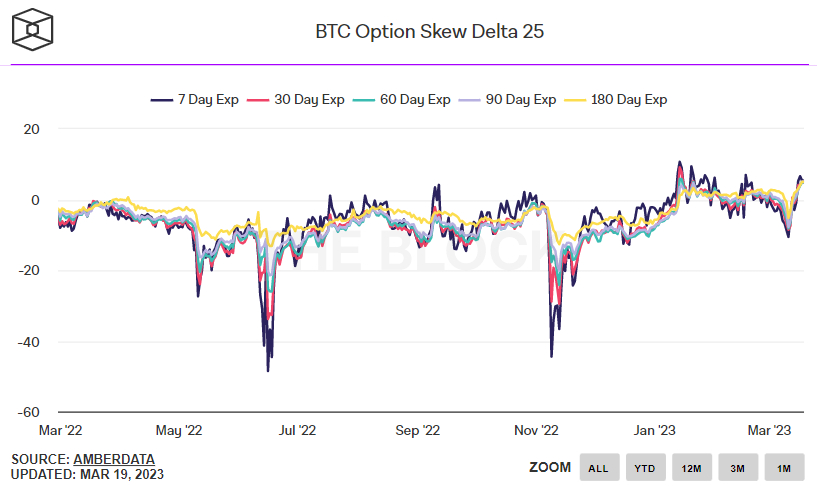

When Bitcoin dipped under $20,000 for the first time in two months last week, the outlook for the BTC price according to the 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days fell to their lowest levels of the year of between -5 to -10.

However, the aggressive price recovery has seen the 25% delta skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days recover rapidly into bullish territory, with all close to 5. For the 7-day 25% delta skew, that’s its highest level since mid-February. For the 30, 60 and 90-day skews, that’s their highest level since mid-January. Finally, for the 180-day skew, that is its highest level since November 2021.

The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors. Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price.

A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is stronger demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

Bitcoin options markets are thus sending a message that investors are positioning for further gains. And that makes sense in the context of recent moves.

Where Next for the BTC Price?

With Bitcoin having now seemingly cleared resistance in the form of the late May 2022 lows in the $28,000 area, the door is now open to a swift test of the psychologically important $30,000 level and then the early June 2022 highs in the $32,500 area. Indeed, there isn’t much by way of any resistance to prevent such a rally.

Fundamentals seem likely to continue to support Bitcoin upside. If this week’s Fed meeting is dovish, associated risk-on flows and easing financial conditions should support the Bitcoin price. If the Fed isn’t as dovish as the market hopes, this could cause a short-term price wobble, but would likely result in further US bank sector strains, which could increase demand for Bitcoin as a safe-haven alternative.

All the while, on-chain trends are looking positive. Core on-chain metrics like the number of non-zero balance wallets, the number of daily transactions, the number of daily active addresses and the rate of new address creation are all trending in the right direction. Alternative indicators such as those tracked in Glassnode’s “Recovering from a Bitcoin Bear” dashboard are (mostly) flashing a bullish signal as well.